The US$ and the Shekel

When we consider banks as money exchangers and lenders, nothing has changed since the time of Jesus.

Now its true that the gospels of the New Testament don’t always agree. For example, Matthew refers to “the Sermon on the Mount”; Luke remembers it as “the Sermon on the Plain”. Did Luke not notice there was a mountain? But one thing all four of the gospels agree on is Jesus booting the moneylenders out of the temple. Historically, moneylenders and exchangers were taking advantage of pilgrims who came to the temple for religious festivals. In an act that will be familiar to anyone who uses a credit card or changes currency at an airport, the system always works in favour of the money exchangers and the moneylenders.

The moneylenders apparently decided Roman currency was not acceptable for temple offerings, for reasons known best to themselves. Sound familiar to the US$ described as the reserve currency of the world? So, pilgrims had to exchange their money for Jewish shekels. The moneychangers charged exorbitant fees to do so.

Then Jesus arrived and tossed their tables over and declared: “Has this house, which bears my name, become a den of robbers to you?”

Ever since then – or possibly before – banks have had a hard time from the righteous, often not without reason. The modern word “bank” actually derives from the Italian word “banco”, which means “bench”, because in medieval Italy, if you wanted to borrow some cash, you had to remove yourself from the church and do your business on the bench outside in deference to Jesus’s “cleansing” of the temple.

Governments have since then regularly intervened to control our money lending banks, using taxpayers’ money. The logic is that banks are usurious, and governments need to step in to rectify market failures.

For example, research from Consumer New Zealand show three-quarters of bank customers think their bank is charging too much in fees. Moves to build up the financial strength of Kiwibank to better compete against the big four Australian owned banks has attracted much attention.

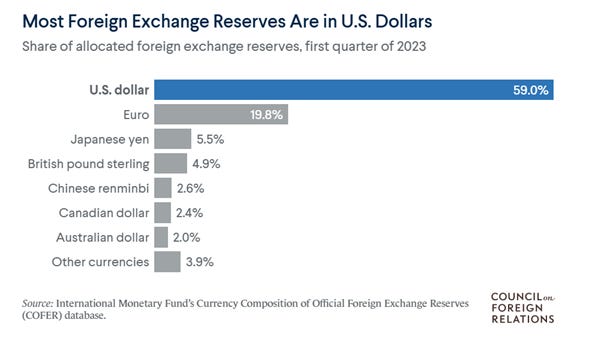

The dollar as the world’s reserve currency

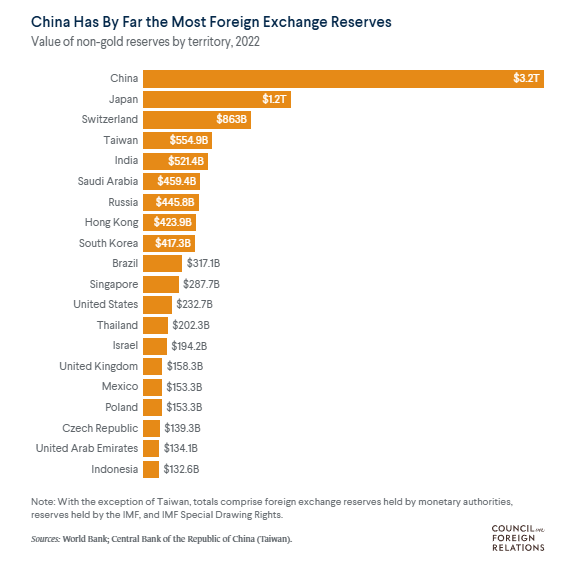

The dollar has been the world's principal reserve currency since the end of World War II and is the most widely used currency for international trade. High global demand for dollars allows the United States to borrow money at a lower cost and use the currency to gain advantage. Its not difficult to imagine that in the present other countries feel just like the pilgrims of biblical times - perhaps similarly hoping for a second coming.